Strategic 529 Planning: Maximize Education Savings 2025

Strategic planning for 529 plans is crucial for maximizing education savings, offering significant financial advantages and flexibility for future academic endeavors in 2025 and beyond.

Embarking on the journey of funding higher education can feel daunting, but with proactive and 529 plan strategic planning, you can significantly ease the financial burden. As we approach 2025, understanding the nuances of these powerful savings vehicles becomes paramount for maximizing your investment and securing a brighter educational future.

Understanding the Basics of 529 Plans for 2025

A 529 plan is an education savings plan sponsored by states, state agencies, or educational institutions. It is designed to help families save for future education costs, offering significant tax advantages. These plans have become an indispensable tool for parents and grandparents looking to invest in a child’s academic journey.

For 2025, the core benefits of 529 plans remain strong, primarily revolving around tax-advantaged growth and tax-free withdrawals for qualified education expenses. This makes them a cornerstone of any comprehensive education savings strategy. It’s not just about saving; it’s about making your money work harder through these specific tax incentives.

Types of 529 Plans

There are generally two types of 529 plans: college savings plans and prepaid tuition plans. Each offers distinct advantages depending on your financial goals and risk tolerance.

- College Savings Plans: These plans allow you to invest contributions in mutual funds, exchange-traded funds (ETFs), or other investment vehicles, with earnings growing tax-deferred. Withdrawals for qualified expenses are tax-free.

- Prepaid Tuition Plans: These plans allow you to purchase future tuition credits at today’s prices, locking in costs and protecting against tuition inflation. They are typically sponsored by states and may have residency requirements.

The choice between these two types depends on factors such as your state of residence, your comfort with investment risk, and whether you want to lock in tuition rates. Both offer valuable pathways to saving for education, but their mechanics differ significantly.

Understanding these fundamental aspects of 529 plans is the first step toward effective strategic planning. Knowing how they operate and what options are available will empower you to make informed decisions tailored to your family’s specific needs and future aspirations. The benefits extend beyond tuition, covering a wide array of educational expenses.

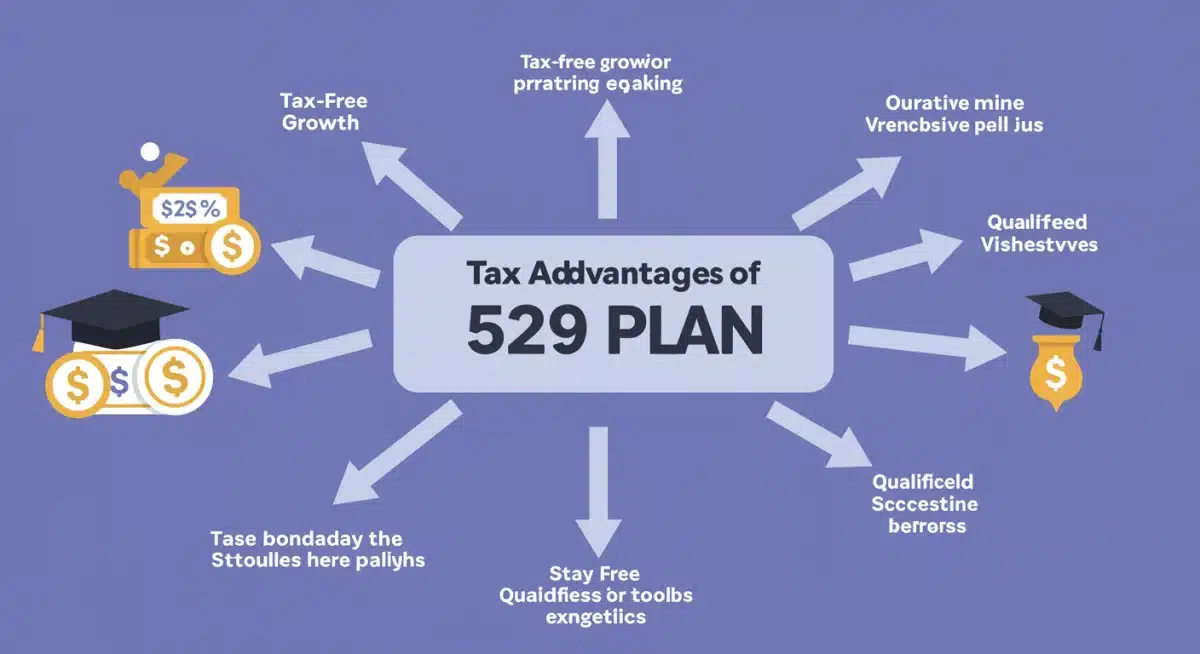

Maximizing Tax Advantages and Financial Impact

One of the most compelling reasons to utilize a 529 plan is its robust tax benefits, which can significantly amplify your education savings. These advantages are multi-layered, affecting everything from annual contributions to withdrawals, and understanding them is key to truly maximizing your financial impact.

Contributions to a 529 plan are typically made with after-tax dollars, meaning there’s no federal tax deduction on your contributions. However, many states offer state income tax deductions or credits for contributions, which can provide an immediate financial benefit. This state-specific incentive is a critical factor in choosing the right plan, even if it’s not your home state’s plan.

Tax-Free Growth and Withdrawals

The true power of a 529 plan lies in its tax-free growth. Earnings on your investments grow free from federal income tax, and in most cases, state income tax. This compounding growth can lead to substantially larger balances over time compared to taxable investment accounts. When funds are withdrawn for qualified education expenses, those withdrawals are also completely tax-free at the federal level, and often at the state level too.

Qualified education expenses are broad, encompassing tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. This includes colleges, universities, vocational schools, and even K-12 tuition expenses up to $10,000 per year per beneficiary. Additionally, expenses for special needs services, room and board (for students enrolled at least half-time), and even student loan repayments (up to $10,000 per beneficiary) are considered qualified, providing immense flexibility.

The financial impact of these tax advantages cannot be overstated. By strategically contributing to a 529 plan, you can leverage tax-free growth and withdrawals to significantly reduce the overall cost of education, leaving more money for your family’s other financial goals. This makes 529 plans a potent tool in your financial planning arsenal for 2025 and beyond.

Choosing the Right 529 Plan: Insider Knowledge for 2025

Selecting the optimal 529 plan requires more than just picking your home state’s offering. Savvy investors understand that exploring options from various states can unlock superior investment choices, lower fees, and better overall performance. This insider knowledge is crucial for making a truly strategic decision for 2025 and the years to come.

While your home state might offer a tax deduction for contributions, comparing its plan against others is vital. Some states offer highly competitive plans with diverse investment options and low administrative fees, even if you are not a resident. The key is to balance potential state tax benefits with the plan’s overall investment quality and cost efficiency.

Factors to Consider When Choosing a Plan

- Investment Options: Look for plans that offer a wide range of investment portfolios, including age-based options, static portfolios, and individual fund choices, allowing you to tailor your strategy to your risk tolerance and timeline.

- Fees and Expenses: High fees can erode your returns over time. Compare administrative fees, underlying fund expenses, and any other charges across different plans.

- State Tax Benefits: While not the only factor, a state income tax deduction or credit can be a significant advantage. Evaluate if your home state offers one and how it compares to potential investment advantages elsewhere.

- Plan Performance: Review the historical performance of the plan’s investment options. While past performance is not indicative of future results, it can provide insight into the plan’s management and strategy.

Don’t be afraid to look beyond your state’s borders. Many of the top-performing 529 plans are open to non-residents, offering a broader selection of investment managers and strategies. This flexibility allows you to select a plan that aligns best with your financial objectives for education savings, regardless of your geographical location.

Ultimately, the right 529 plan for you is one that balances tax advantages, low fees, strong investment options, and a track record of reliable performance. Taking the time to research and compare these elements will pay dividends in maximizing your education savings for 2025 and beyond.

Strategic Contribution Strategies for Optimal Growth

Beyond simply opening a 529 plan, developing a strategic contribution plan is essential for maximizing its growth potential. This involves understanding contribution limits, gift tax implications, and how to leverage various funding sources to build a substantial education fund over time. Effective planning can make a significant difference in the final balance.

The IRS imposes certain limits on contributions to 529 plans to prevent them from being used as tax shelters. While there isn’t an annual federal contribution limit, large contributions can trigger gift tax rules. However, 529 plans offer a unique gifting provision: you can contribute up to five years’ worth of annual gift tax exclusion in a single year without incurring gift tax, provided you elect to treat the contribution as if it were made ratably over the five-year period. For 2025, this could be a substantial amount, allowing for significant upfront funding.

Leveraging Gifting and Other Sources

- Annual Gift Tax Exclusion: Utilize the annual gift tax exclusion to make regular contributions without tax implications. This allows multiple family members to contribute.

- Front-Loading Contributions: For those with substantial funds, front-loading five years of contributions can jumpstart tax-free growth.

- Grandparent Contributions: Grandparents can contribute to 529 plans, potentially reducing their taxable estate. Recent FAFSA changes have also made grandparent-owned 529 plans less impactful on financial aid eligibility, further enhancing their appeal.

- Unexpected Windfalls: Consider directing bonuses, tax refunds, or inheritances into a 529 plan to give your savings a boost.

It’s also important to consider the impact of 529 plan assets on financial aid eligibility. Generally, 529 plans owned by a parent or dependent student are treated favorably, with only a small percentage of their value counting against financial aid. This makes them a more attractive savings vehicle than assets held directly in the student’s name.

By strategically timing contributions, understanding gift tax exclusions, and leveraging contributions from various family members, you can significantly accelerate the growth of your 529 plan. This proactive approach ensures your education savings are robust and ready for future educational expenses, solidifying your 529 plan strategic planning.

Managing Your 529 Plan: Investment Strategies for Long-Term Success

Effective management of your 529 plan goes beyond initial setup and contributions; it involves ongoing investment strategy adjustments to align with your beneficiary’s age and market conditions. A dynamic approach ensures your savings are optimized for long-term success, adapting as the education goal draws nearer.

Most 529 plans offer age-based portfolios, which automatically adjust their asset allocation from more aggressive (higher stock allocation) when the beneficiary is young to more conservative (higher bond allocation) as they approach college age. This hands-off approach is suitable for many, but active management can sometimes yield better results for those comfortable with more involvement.

Rebalancing and Risk Management

Regularly reviewing your investment options and rebalancing your portfolio is a critical component of 529 plan management. This ensures your risk exposure remains appropriate for your timeline. For instance, as your child gets closer to college, shifting a larger portion of funds into more stable investments can help protect against market downturns right before you need the money.

- Annual Review: Conduct an annual review of your plan’s performance and asset allocation.

- Risk Assessment: Reassess your risk tolerance as the beneficiary ages and market conditions change.

- Investment Option Changes: Most plans allow two investment option changes per calendar year, offering flexibility to adapt your strategy.

Be mindful of market fluctuations and resist the urge to make emotional decisions. A well-thought-out investment strategy, even if it’s an age-based portfolio, is designed to weather market volatility. Sticking to your plan and making informed, strategic adjustments are key to harnessing the full growth potential of your 529 plan.

By actively managing your 529 plan investments, you ensure that your savings remain on track to meet your educational funding goals. This proactive stance, coupled with informed decisions about asset allocation and risk, forms a crucial part of maximizing your education savings for 2025 and beyond.

Navigating Withdrawals and Qualified Expenses

Understanding the rules around withdrawals from your 529 plan is just as important as understanding contributions. Improper withdrawals can lead to taxes and penalties, negating the benefits of careful planning. Knowing what constitutes a qualified expense is paramount to maintaining the tax-free status of your distributions.

As previously mentioned, qualified education expenses include tuition, fees, books, supplies, and equipment. For students enrolled at least half-time, room and board expenses are also covered, up to the amount specified by the eligible educational institution for financial aid purposes. This broad definition provides significant flexibility in how 529 funds can be utilized.

Avoiding Non-Qualified Withdrawals

A non-qualified withdrawal occurs when funds are used for expenses that do not meet the IRS’s definition of qualified education expenses. These withdrawals are subject to federal income tax on the earnings portion, plus a 10% federal penalty tax. State taxes and penalties may also apply. Common mistakes include using funds for transportation, health insurance, or general living expenses not directly tied to educational costs.

- Keep Detailed Records: Maintain meticulous records of all education-related expenses and 529 withdrawals.

- Understand Eligibility: Ensure the educational institution is eligible and the student is enrolled at least half-time for room and board expenses.

- Coordinate with Financial Aid: Be aware of how 529 withdrawals might interact with other forms of financial aid to avoid overpaying or underutilizing funds.

It’s also important to consider beneficiary changes. If the original beneficiary decides not to pursue higher education, you can change the beneficiary to another eligible family member without tax consequences. This flexibility ensures that your savings can still be used for educational purposes within your family.

Careful planning and adherence to the IRS guidelines for qualified expenses are crucial when making withdrawals from your 529 plan. By doing so, you can enjoy the full tax-free benefits of your hard-earned savings and confidently fund your beneficiary’s education without unexpected financial setbacks.

Future Outlook: 529 Plans in 2025 and Beyond

The landscape of education savings is constantly evolving, and staying abreast of potential changes to 529 plans is vital for long-term strategic planning. As we look towards 2025 and beyond, understanding anticipated trends and legislative developments can help you adapt your strategy and continue to maximize your education savings.

One significant development is the ability to roll over unused 529 funds into a Roth IRA, effective from 2024, thanks to the SECURE 2.0 Act. This provision allows beneficiaries to transfer up to $35,000 from a 529 account to a Roth IRA, tax and penalty-free, provided the 529 account has been open for at least 15 years and contributions made within the last five years are not rolled over. This adds an incredible layer of flexibility for unused funds, addressing a long-standing concern for many savers.

Potential Legislative Changes and Adaptations

While the core benefits of 529 plans are expected to remain stable, minor legislative adjustments or expansions of qualified expenses are always possible. Financial advisors often monitor these developments closely, and staying informed through reliable sources can provide a significant advantage in adapting your 529 plan strategic planning.

- Monitoring Legislation: Keep an eye on federal and state legislative discussions that could impact 529 plans.

- Consulting Experts: Regularly consult with a financial advisor specializing in education planning to stay informed of changes and optimize your strategy.

- Reviewing Plan Documents: Periodically review your chosen 529 plan’s documents for any updates to fees, investment options, or rules.

The flexibility offered by 529 plans, particularly with recent changes like Roth IRA rollovers, makes them an even more attractive savings vehicle. This adaptability ensures that even if a beneficiary’s educational path changes, the accumulated funds retain significant value and utility.

The future of 529 plans appears robust, with ongoing efforts to enhance their utility and flexibility. By staying informed and proactively adjusting your strategy, you can ensure your 529 plan remains a powerful tool for maximizing education savings for decades to come, providing peace of mind and financial security for your family’s educational aspirations.

| Key Aspect | Brief Description |

|---|---|

| Tax Advantages | Tax-free growth and withdrawals for qualified education expenses, plus potential state deductions. |

| Plan Selection | Compare plans across states for best investment options, fees, and state tax benefits. |

| Contribution Strategy | Utilize annual gift tax exclusion and front-loading to maximize growth and leverage contributions. |

| Withdrawal Rules | Ensure withdrawals are for qualified expenses to avoid taxes and penalties. |

Frequently Asked Questions About 529 Plans

The main tax benefits include tax-free growth on investments and tax-free withdrawals for qualified education expenses. Many states also offer income tax deductions or credits for contributions, providing an immediate financial incentive to save.

Yes, 529 plans can be used to pay for up to $10,000 per year per beneficiary in tuition expenses for K-12 public, private, or religious schools. This flexibility was added with the Tax Cuts and Jobs Act of 2017.

Unused 529 funds can be rolled over to another eligible family member’s 529 plan without penalty. Additionally, starting in 2024, up to $35,000 can be rolled over to the beneficiary’s Roth IRA under specific conditions.

Parent-owned 529 plans are generally treated favorably, with only a small percentage (up to 5.64%) counted as an asset for financial aid calculations. Student-owned 529s are also treated as parent assets. Grandparent-owned plans also have minimal impact.

Yes, account owners are generally allowed to change investment options twice per calendar year. This flexibility enables you to adjust your portfolio strategy based on market conditions or your risk tolerance as the beneficiary ages.

Conclusion

The strategic planning for 529 plans is an indispensable component of securing a financially sound educational future. By understanding the various types of plans, maximizing their inherent tax advantages, making informed choices about plan selection, and implementing smart contribution and withdrawal strategies, families can significantly enhance their education savings. As we move into 2025 and beyond, staying informed about legislative changes and adapting your approach will ensure your 529 plan remains a powerful, flexible tool for achieving educational aspirations. Proactive engagement with your 529 plan is not just about saving money; it’s about investing in a brighter tomorrow for the next generation.